141: What it takes to build & scale a $100M lifestyle brand with Jake Kassan

Do you want to know what it really takes to build a $100 million business and brand? Then this episode is for you.

Posted by: Austin Brawner on May 03, 2018

Imagine waking up tomorrow, with an inbox stuffed full of emails from half of your customers letting you know they’re never going to purchase from you again.

Sounds like a disaster, right?

Now, what if I told you that losing 50% of your customers would only reduce your revenue by 10%, and by the end of the year you would actually be making more money than before because you had been able to reduce customer support hours by 75%.

Probable? No.

Possible. Very much so.

It’s a scenario that I’ve seen myself. After running the numbers for one of my clients, we realized that the bottom 50% of their customers were accounting for about 10% of their revenue, while causing the vast majority of their customer service issues.

If the bottom half of their customers never purchased from them again, they would only lose 10% of their revenue, but it would allow them to pare down their customer support staff enough that their business would be better off.

While this is an extreme example of what can happen when you calculate out the value of your customers, similar results are not uncommon.

If you do only one thing over the next month to help with marketing, please make it this. I can’t think of a more important place to start improving your marketing than determining how much a customer is worth to you.

After I go through this today, I’m going to ask only one thing of you, and that’s to make some time in your schedule to make this calculation.

I’m going to break this down for you as simple as I can because I feel it’s a daunting task for many businesses when it shouldn’t be! It’s not terribly complicated, and anyone with a little experience and access to the right numbers should be able to do it.

(If you are told that it’s more complicated than this, beware, because it probably means someone is trying to sell you something.)

I’m going to cover four main questions that come up when exploring this topic.

In the hands of a creative business person, I can think of few things more important than determining what a customer is worth to an organization over their business lifetime.

It’s so important because it will provide you with an idea of what you can spend to acquire a new customer.

This hilarious referral program set up by VinoMofos.com nails it. They are willing to pay $25 for a new customer because they know that $25 will come back to them in the future.

Here’s a little secret….

You didn’t think they were, did you?

Ryan Kelly from Pear Metrics does a great job of illustrating this in his post The Importance of Lifetime Value in Marketing

Another mistake marketers make is assuming that all of your customers are exactly the same in terms of revenue per customer, cost per acquisition and other metrics. This is wrong. Let me illustrate:

For many, the majority of their customers are going to fall in the middle of being fairly active and profitable customers, while about 20% are relatively inactive (or customers who use up a lot of support, rarely upgrade or buy peripheral products), and another 20% who are highly active. The 20% of highly active customers are really your “brand evangelists”. These are folks who refer a lot of new customers, upgrade frequently, and generally purchase on any cross-sell opportunity because they truly love your product or service.

In every instance of calculating out lifetime value, my clients have found they are spending more time and money on customers that are worth nothing too them, and not enough to get the customers that really count.

Ok, so….

Calculating the LTV (that’s what I’m going to call it because Lifetime Value is WAY too long for me) is not something you are going to be able to find in Google Analytics, but it also doesn’t take extensive math.

Lifetime Value (LTV) = Total Customer Revenue – Total Customer Costs

Which means all we need to do is find the Total Customer Revenue, then subtract the customer costs.

I’ve found the best way to learn is to watch someone else do it first, then try to parallel their business to your own.

Here’s a training video I put together for you to help you get started calculating LTV for your business.

Neil Patel and his team over at Kiss Metrics have put together a fantastic case study about how Starbucks calculates its lifetime value of a customer.

Before you click let’s make this more fun, put a number in your head that you think is reasonable for how much the average customer spends at Starbucks over their lifetime.)

Now let’s walk through this Fantastic Lifetime Value Resource

++ Click Image to Enlarge ++

Source: How To Calculate Lifetime Value

There are a lot of products out there that will help you with this, but while they make it easier, none of these products are necessary.

All you need is a customer sales records and requires that you wade through the numbers and learn how often your customers are purchasing, and how much they are spending with each purchase.

You can see how they are calculating LTV. They are using three different formulas, to get started I would focus on the most simple one.

Once I have an idea of the LTV, it’s important to become more granular and segment customers down in to groups based on their purchasing habits. This is to analyze them and find common characteristics of the best (and worst) customers. The typical breakdown I will do for an ecommerce company is this.

When the customers are broken down in groups, of this sort, I begin to ask questions about my most profitable customers.

Here are some good questions to ask:

It’s not uncommon for your best customers to come from the same places. Makes sense, right?

The people who spend the most all are looking for the same thing, and the ones who spend the least are looking for the same things.

You may find that a certain keyword is providing you with a much better return than the others.

When you segment, here are some examples of what to look for.

Specific Google Adwords Campaigns (Do certain keywords produce more profitable customers?)

Example: Does someone who signs up from the keyword “Cheap Wayfarer Sunglasses” end up spending as much as someone who comes from the keyword “Red wayfarer sunglasses”?

Referral Customers (How much does the average customer who is acquired by referral spend?)

Example: Research by Harvard Business Review found that referral programs can drive stunning profits, and referral customers are typically 16% more profitable than normal customers.

Facebook Ads (Are these customers more valuable than other customers?)

Example: You might find the customers driven to your website from Facebook could be worth half as much to you as the customers who come in from Google Adwords.

Where are the good ones coming from? And how much am I spending on the good ones?

Once you answer these questions, it’s time to devote yourself to acquiring more of the good customers, and less of the bad ones.

Are you a SaaS or ecommerce business? There are lots of resources to help you start to learn more about your customers. You can use KissMetrics for this, or MixPanel.

Avinash Kaushik analyzes the lasting impact of “buying cheap customers” in a fantastically researched post.

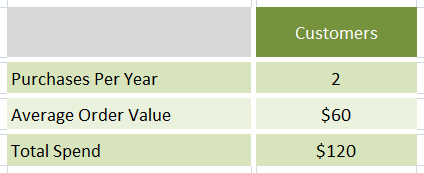

Take this example of a company that has just analyzed its customer database over the last 2 years and has come to this conclusion:

This means the average customer spends $120 a year, and we can project for how many years to find the average LTV.

Getting this number is not enough to really learn about your customers.

“The trouble with averages is they conceal all the really interesting stuff that’s going on beneath the surface. If you look beyond the averages you’ll find that some of your clients are “better than average” and some are “worse than average”-Avinash Kaushik”

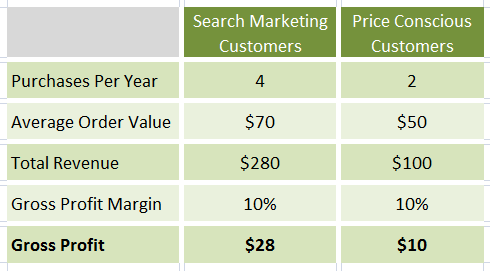

He focuses on the segmentation of your customers and gives an example of the different purchasing habits of people from different lead sources.

He compares customers acquired from the search marketing for an average cost of $8, and price conscious customers that have been purchased from an intermediary at a fixed rate of $4.

50% less to acquire a customer sounds great, but when the numbers are run he gets a different outcome.

If you don’t have a budget for the tools like MixPanel or Kiss Metrics, there is another way and it involves using Pivot Tables in Excel. If you are exporting customer sales records in .csv files, it’s possible to rearrange them and add customer orders together.

Here is a good place to start if you want to learn more about Pivot Tables. If you want some more information about this, please comment and I’ll do a post teaching you.

It’s important for you to use the number that you come up with to determine your strategies in marketing going forward. The most important thing you can glean from learning the LTV is your possible customer acquisition cost.

If you know that a new customer is worth $45 to you over their lifetime, and $20 of that is profit, you can get an idea of the budget you have to acquire new customers and maintain profitability.

This is a very high level overview of lifetime value, and I realize that many organizations have entire teams of people dedicated to figuring this stuff out.

Hopefully, it can inspire some of you to get out there and give a stab at calculating it.

If you have questions, please leave it in the comments and I would be happy to do a follow up post to answer common questions!

Enter your email to get our proven resources that will help you achieve massive growth without the burnout.