141: What it takes to build & scale a $100M lifestyle brand with Jake Kassan

Do you want to know what it really takes to build a $100 million business and brand? Then this episode is for you.

Posted by: Austin Brawner on May 03, 2018

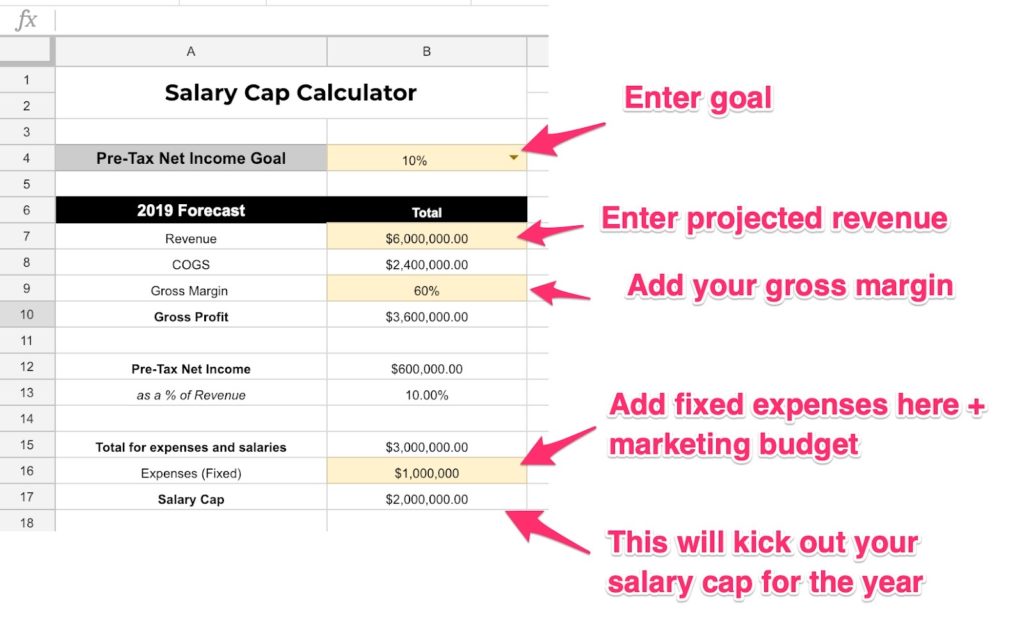

Over the last several years, I’ve helped 126 ecommerce brands build more profitable businesses. 78 of them scaled into 7-figure businesses. 2 of them had $100 million dollar exits.

Through this experience, I’ve learned that if you observe certain principles as you scale, you’ll increase your chance of doing it profitably.

Today I share my 3-step formula for profitably scaling your ecommerce business. Enjoy!

If you want to scale up fast, while remaining profitable, we can help. We’ve worked with hundreds of early-stage eComm owners to pour the fuel on their businesses and level up from 6-figures to unstoppable 7-figure success.

This isn’t just getting you set up with the latest FB ads strategy or email marketing. We’ll help you see the big picture on how you can build and scale a profitable company with the right systems in place.

Are you ready to make your first million? Click here and LET’S GO!

Today’s episode is brought to you by Klaviyo. Over 10,000 brands have joined Klaviyo to help them build higher-quality relationships with their customers. Klaviyo does not force you to compromise between speed and powerful functionality, you get both. Interested to see Klaviyo’s impact? Tune into their 12-part docu-series following three brands—Chubbies, SunSki and the Love Is Project. You’ll learn how they prepared for Cyber Weekend 2018, marketing throughout the holidays, and beyond. Along the way, we’ll fill you in on what you should be doing as a business to push your marketing strategy to the next level.

Also, as you’re going through this, they’re going to show you how to prepare the business to continue to take it to the next level segment and grow and use it to use Klaviyo to drive more profitable interactions. If you want to go check out this docu-series, go to www.ecommerceinfluence.com/beyond.

Enter your email to get our proven resources that will help you achieve massive growth without the burnout.